Exploring the world of shopping for car insurance quotes online can be both daunting and crucial. By understanding what to look for, you can navigate through the sea of options with ease and confidence. This guide will walk you through the key factors to consider, coverage options to understand, tools to utilize, and tips to save money on your car insurance.

Let's dive in!

Factors to Consider When Shopping for Car Insurance Quotes Online

When it comes to shopping for car insurance quotes online, there are several important factors to consider to ensure you are getting the best coverage for your needs at a competitive price.

Importance of Coverage Limits, Deductibles, and Types of Coverage

- Coverage Limits: Make sure to understand the coverage limits offered by different insurance companies. Higher coverage limits may provide better protection but could also mean higher premiums.

- Deductibles: Consider the deductible amount you are comfortable with paying out of pocket in the event of a claim. A higher deductible usually results in lower premiums.

- Types of Coverage: Evaluate the types of coverage offered, such as liability, comprehensive, collision, uninsured/underinsured motorist, and personal injury protection. Choose the ones that best suit your needs and budget.

Insurance Company's Reputation and Customer Reviews

- Reputation: Research the insurance company's reputation for customer service, claims handling, and financial stability. A reputable company is more likely to provide reliable coverage and support when you need it.

- Customer Reviews: Read customer reviews and ratings to gauge the experiences of policyholders with the insurance company. Positive reviews can indicate good service and efficient claims processing.

Tips for Accurate Quote Comparisons

- Provide Accurate Information: Ensure that you provide accurate and up-to-date information about your driving history, vehicle, and coverage needs to receive precise quotes.

- Compare Apples to Apples: When comparing quotes, make sure the coverage limits, deductibles, and types of coverage are similar across different insurance companies for a fair comparison.

- Ask About Discounts: Inquire about available discounts, such as multi-policy, safe driver, or bundling discounts, to potentially lower your premiums.

Understanding Coverage Options

When shopping for car insurance quotes online, it's essential to understand the different coverage options available to ensure you get the right protection for your needs.

Liability Coverage

Liability coverage helps pay for the other driver's expenses if you're at fault in an accident. This coverage is mandatory in most states and typically includes bodily injury and property damage liability.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if it's damaged in a collision with another vehicle or object. This coverage is optional but can be beneficial if you have a newer car.

Comprehensive Coverage

Comprehensive coverage helps pay for damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters. This coverage is also optional but can provide valuable protection.

Personal Injury Protection

Personal Injury Protection (PIP) coverage helps pay for medical expenses for you and your passengers if you're injured in an accident, regardless of who is at fault. This coverage is required in some states and can be beneficial for covering medical costs.

Additional Coverage Options

In addition to the basic coverages mentioned above, there are other optional coverages you may want to consider. These include uninsured/underinsured motorist coverage, rental reimbursement, roadside assistance, and gap insurance. Each of these coverages provides additional protection in specific situations, so it's essential to evaluate your needs carefully.

Utilizing Online Tools and Calculators

When shopping for car insurance quotes online, utilizing various tools and calculators can make the process easier and more efficient. These tools are designed to help you compare quotes from different insurance providers quickly and accurately. By using them effectively, you can ensure that you are getting the best coverage at the most competitive rates.

Comparing Different Online Tools

- Insurance Comparison Websites: These websites allow you to input your information once and receive quotes from multiple insurance companies. They streamline the comparison process and provide you with a comprehensive overview of available options.

- Insurance Calculators: Calculators help you estimate the coverage you need based on factors like your vehicle type, driving history, and location. They can also give you an idea of how different coverage levels affect your premiums.

Tip: Make sure to input accurate information to get the most relevant quotes.

Using Online Tools Effectively

- Provide Accurate Information: To receive accurate quotes, ensure that you enter correct details about your vehicle, driving history, and coverage preferences.

- Compare Quotes: Use different online tools to compare quotes from various insurance companies. This will help you identify the most cost-effective option for your needs.

- Consider Additional Features: Some online tools may offer additional features such as customer reviews, claim satisfaction ratings, and discounts. Take advantage of these to make an informed decision.

Tips for Saving Money on Car Insurance

When it comes to car insurance, finding ways to save money is always a top priority for drivers. There are several strategies you can implement to lower your premiums and keep more money in your pocket.

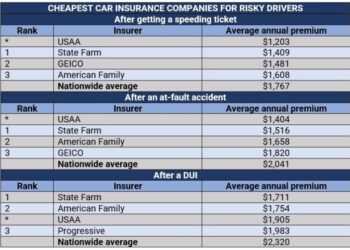

Impact of Driving Record, Vehicle Type, and Location

- Having a clean driving record can significantly lower your insurance rates. Avoiding accidents and traffic violations shows insurance companies that you are a responsible driver.

- The type of vehicle you drive can also affect your insurance premiums. Generally, newer and more expensive cars will cost more to insure due to higher repair or replacement costs.

- Your location plays a role in determining your insurance rates. Urban areas with higher rates of accidents or theft may result in higher premiums compared to rural areas.

Bundling Policies, Discounts, and Cost-Saving Measures

- Bundling your car insurance with other policies, such as home or renters insurance, can lead to discounts on your premiums.

- Many insurance companies offer discounts for factors like good grades for students, safety features on your vehicle, or completing a defensive driving course.

- Consider raising your deductible to lower your premium, but make sure you have enough savings to cover the higher out-of-pocket costs in case of an accident.

Reviewing and Updating Your Policy

- Regularly reviewing your policy and updating your coverage based on changes in your driving habits or life circumstances can help you save money.

- As your car ages or your financial situation improves, you may be able to adjust your coverage levels to reflect these changes and potentially lower your premiums.

- Shopping around for quotes from different insurance companies can also help you find the best rates and potentially save money on your car insurance.

Final Review

In conclusion, shopping for car insurance quotes online requires attention to detail and a clear understanding of your needs. By keeping in mind the factors discussed in this guide, you can make an informed decision that protects you and your vehicle.

Remember to compare quotes carefully, explore coverage options thoroughly, and take advantage of available tools to streamline the process. Happy shopping and safe driving!

Quick FAQs

What factors should I consider when comparing car insurance quotes online?

When comparing quotes online, consider coverage limits, deductibles, types of coverage, and the insurance company's reputation.

What are some common coverage options to look out for?

Common coverage options include liability, collision, comprehensive, and personal injury protection. Each serves a specific purpose based on different situations.

How can I save money on car insurance premiums?

You can save money by maintaining a good driving record, choosing the right vehicle, bundling policies, and taking advantage of available discounts.