Exploring the landscape of Business General Liability Insurance in 2025: A Breakdown sets the stage for a deep dive into the evolving trends and developments that shape the insurance industry.

This comprehensive analysis sheds light on the changes in coverage, policy evolution, and the impact of digital transformation, offering a glimpse into the future of business insurance.

Overview of Business General Liability Insurance in 2025

General liability insurance has a long history dating back to the early 20th century when it was introduced to protect businesses from legal claims and lawsuits. Over the years, it has become a crucial component of risk management for companies across various industries.

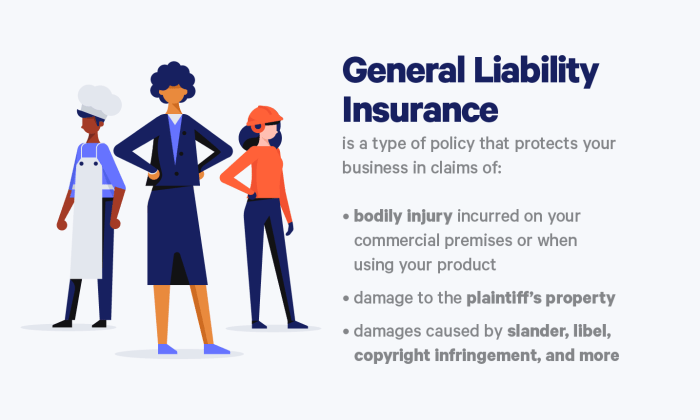

Business general liability insurance plays a vital role in safeguarding companies against financial losses resulting from third-party claims of bodily injury, property damage, or advertising injury. It provides coverage for legal defense costs, settlements, and judgments, offering peace of mind to business owners and protecting their assets.

The Evolving Landscape of the Insurance Industry

In 2025, the insurance industry continues to evolve rapidly, driven by technological advancements, changing consumer behaviors, and regulatory developments. This evolution has a direct impact on the coverage and options available for business general liability insurance.

- Increased Customization: Insurers are offering more customized policies to meet the specific needs of different businesses, allowing for greater flexibility and tailored coverage.

- Digital Transformation: The adoption of digital tools and platforms is streamlining the insurance process, from underwriting to claims handling, making it more efficient and accessible for businesses.

- Risk Assessment: Insurers are leveraging data analytics and artificial intelligence to improve risk assessment models, enhancing their ability to price policies accurately and identify potential liabilities.

- Emerging Risks: With the changing business landscape, new risks such as cyber threats, climate change, and supply chain disruptions are gaining prominence, prompting insurers to offer specialized coverage options.

Trends and Developments in Business General Liability Insurance

In the rapidly evolving landscape of business general liability insurance, several key trends and developments are shaping the future of the industry. From technological advancements to global events, these factors are influencing insurance products and services in significant ways.

Impact of Emerging Technologies

The integration of emerging technologies such as artificial intelligence (AI), Internet of Things (IoT), and blockchain is revolutionizing the way general liability insurance is underwritten, priced, and managed. AI-powered algorithms are being utilized to assess risks more accurately, while IoT devices provide real-time data for proactive risk mitigation.

Blockchain technology is enhancing transparency and security in claims processing, leading to faster settlements and reduced fraud.

Global Events and Economic Changes

Global events, such as pandemics, natural disasters, and geopolitical tensions, have a profound impact on insurance coverage and risk assessment. The COVID-19 pandemic, for example, highlighted the importance of business interruption coverage and the need for more comprehensive policies to protect against unforeseen disruptions.

Economic changes, such as inflation or market fluctuations, also influence insurance pricing and coverage limits, requiring insurers to adjust their offerings accordingly.

Shift towards Personalized Policies

With the increasing availability of data and analytics, insurers are moving towards personalized policies tailored to the specific needs and risk profiles of businesses. This trend allows for more precise underwriting, pricing, and coverage customization, ensuring that policyholders are adequately protected against their unique risks.

Insurers are leveraging data from various sources, including social media, IoT devices, and telematics, to offer personalized solutions that align with the evolving needs of businesses.

Changes in Coverage and Policies

In the ever-evolving landscape of business general liability insurance, it is crucial to stay informed about the changes in coverage and policies to ensure adequate protection for your business.

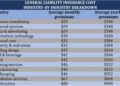

Typical Coverage Included in a Business General Liability Insurance Policy

- Bodily Injury Coverage: This type of coverage helps protect your business in case someone is injured on your premises or as a result of your business operations.

- Property Damage Coverage: This coverage can help pay for damages to someone else's property caused by your business activities.

- Personal and Advertising Injury: Covers claims of slander, libel, copyright infringement, and other similar claims.

- Medical Payments: This coverage helps pay for medical expenses if someone is injured on your business premises, regardless of fault.

New Types of Liability Coverage Expected to Emerge by 2025

- Cyber Liability Insurance: With the increasing threat of cyber attacks, businesses are expected to seek coverage for data breaches, ransomware attacks, and other cyber-related risks.

- Pandemic Liability Insurance: In light of the recent global pandemic, businesses may start looking for coverage to protect against losses resulting from future pandemics or similar events.

Evolution of Policy Limits and Exclusions to Meet Future Business Needs

- Increased Policy Limits: As businesses face higher risks and potential losses, insurance companies may offer higher policy limits to ensure adequate coverage.

- New Exclusions for Emerging Risks: With new technologies and business practices emerging, insurance policies may include exclusions for specific risks that were not prevalent before, such as nanotechnology or artificial intelligence-related liabilities.

Impact of Digital Transformation

In the realm of business general liability insurance, digital transformation has revolutionized the way insurance companies operate, offering, and manage their services. With the integration of advanced technologies, the insurance industry has witnessed significant changes in the processes of underwriting policies, assessing risks, and interacting with customers.

Role of Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics play a crucial role in the underwriting process of general liability insurance policies. By leveraging AI algorithms and data analytics tools, insurance companies can analyze vast amounts of data to accurately assess risks and determine appropriate coverage for businesses.

These technologies help in streamlining the underwriting process, reducing manual errors, and providing more personalized insurance solutions for clients.

Disruption by Online Platforms and Insurtech Companies

The emergence of online platforms and insurtech companies has disrupted the traditional insurance model by offering innovative solutions and services to businesses. These platforms provide convenient and user-friendly interfaces for customers to purchase insurance policies, file claims, and manage their coverage online.

Insurtech companies leverage digital technologies to enhance the overall customer experience, improve operational efficiency, and introduce new products tailored to the evolving needs of businesses.

Summary

In conclusion, the breakdown of Business General Liability Insurance in 2025 highlights the crucial role of insurance in safeguarding businesses amidst a rapidly changing environment. Stay informed, stay protected.

Key Questions Answered

What are the typical coverage included in a business general liability insurance policy?

A typical policy includes coverage for bodily injury, property damage, advertising injury, and legal defense costs.

Are there any new types of liability coverage expected to emerge by 2025?

Cyber liability insurance is expected to become more prominent as businesses face increasing cybersecurity risks.

How is digital transformation influencing the insurance industry?

Digital transformation is revolutionizing insurance processes, making them more efficient and customer-centric through the use of AI and data analytics.