Shop for Auto Insurance: The Ultimate 2025 Guide sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve into the world of auto insurance shopping in 2025, we witness a dynamic landscape that is constantly evolving. Stay tuned as we explore the latest trends, technological advancements, and key considerations to help you navigate the complex world of auto insurance with ease.

Introduction to Auto Insurance Shopping in 2025

In 2025, the landscape of auto insurance is rapidly evolving, influenced by various factors such as technology, changing consumer behaviors, and regulatory updates. It is crucial for individuals to understand the shifting trends in auto insurance to make informed decisions when shopping for coverage.

Staying updated with the latest auto insurance trends is essential to ensure that you are getting the best coverage at the most competitive rates. With advancements in technology and data analytics, insurance companies are able to tailor policies more accurately to individual needs, making it imperative for consumers to be aware of these developments.

Impact of Technology on Auto Insurance Shopping

Technology is playing a significant role in shaping the future of auto insurance shopping. From online platforms that allow for easy comparison of quotes to telematics devices that track driving behavior, technology is empowering consumers to make more informed choices when selecting auto insurance policies.

Factors to Consider When Shopping for Auto Insurance

When shopping for auto insurance, it is essential to consider various factors that can affect your insurance rates. Understanding these key factors can help you make informed decisions and potentially save money on your premiums.

Key Factors Affecting Auto Insurance Rates

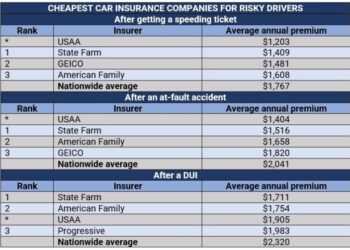

- Your driving record: The cleaner your driving record, the lower your insurance premiums are likely to be. Accidents, traffic violations, and DUIs can all result in higher rates.

- Your age and gender: Younger drivers and males tend to pay higher premiums due to statistical risk factors associated with these demographics.

- The type of car you drive: The make and model of your vehicle, as well as its age and safety features, can impact your insurance rates.

- Your location: Where you live and park your car can affect your rates, with urban areas typically having higher premiums due to increased risks of accidents and theft.

Changes in Driving Habits Impacting Insurance Premiums

- Usage-based insurance: Insurers are increasingly using telematics and GPS technology to track driving habits such as mileage, speed, and braking patterns. Safe drivers may be rewarded with lower premiums.

- Ridesharing and car-sharing: If you use your vehicle for ridesharing services or share it with others, this can impact your insurance rates as it increases the risk associated with your vehicle.

Role of AI and Data Analytics in Determining Insurance Quotes

AI and data analytics play a crucial role in determining insurance quotes by analyzing vast amounts of data to assess risk factors accurately. Insurers use sophisticated algorithms to predict claims likelihood, personalize premiums, and detect fraudulent activities, ultimately helping them offer competitive rates to customers.

Comparison of Traditional vs. Online Auto Insurance Shopping

When it comes to shopping for auto insurance in 2025, consumers have the option to choose between traditional brick-and-mortar agencies and online platforms. Each option comes with its own set of advantages and disadvantages, as well as differences in customer service and accessibility.

Advantages and Disadvantages of Traditional Brick-and-Mortar Agencies

Traditional brick-and-mortar agencies provide a more personalized experience, allowing customers to speak directly with an agent and ask questions face-to-face. This can be beneficial for those who prefer a human touch and value in-person interactions. However, visiting physical locations may be time-consuming and less convenient, especially for those with busy schedules.

Additionally, traditional agencies may have higher overhead costs, which could result in slightly higher premiums for customers.

Advantages and Disadvantages of Online Platforms

On the other hand, online auto insurance shopping offers convenience and accessibility. Customers can compare quotes from multiple providers, purchase policies, and manage their accounts from the comfort of their own homes. This can save time and eliminate the need for in-person visits.

However, some customers may miss the personalized touch and immediate assistance that comes from speaking with an agent face-to-face. Online platforms also rely heavily on self-service, which may be challenging for those who are not tech-savvy.

Customer Service Differences

Customer service in traditional brick-and-mortar agencies often involves building relationships with agents who can provide personalized advice and guidance. On the other hand, online auto insurance providers typically offer customer support through phone, email, or chat services. While online platforms may provide quick responses and 24/7 accessibility, some customers may prefer the reassurance of speaking directly with an agent in person.

Convenience and Accessibility of Online Auto Insurance Shopping

Online auto insurance shopping offers unparalleled convenience and accessibility. Customers can compare quotes, research policies, and make purchases at any time of the day or night. This flexibility allows consumers to take their time and make informed decisions without feeling pressured.

Additionally, online platforms often streamline the process, making it easier for customers to get the coverage they need quickly and efficiently.

Understanding Coverage Options in 2025

In 2025, auto insurance policies offer a variety of coverage options that can protect drivers financially in case of accidents or other incidents on the road. It is essential for individuals to understand these coverage options to ensure they have the appropriate level of protection for their needs.

Standard Coverage Options

- Liability Coverage: This covers damages and injuries to other people or their property if you are at fault in an accident.

- Collision Coverage: This pays for damages to your own vehicle in the event of a collision with another vehicle or object.

- Comprehensive Coverage: This covers damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection: This covers medical expenses for you and your passengers regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or enough insurance to cover your damages.

Emerging Trends in Coverage Options

- Usage-Based Insurance: This type of coverage allows insurers to track your driving habits through telematics devices installed in your vehicle. Premiums are based on how safely you drive, incentivizing good driving behavior.

- Personalized Coverage: Insurers are increasingly offering customizable coverage options that allow policyholders to tailor their insurance policies to their specific needs and preferences.

- Ride-Sharing Coverage: With the rise of ride-sharing services, some insurers now offer coverage options specifically designed for drivers who use their personal vehicles for commercial purposes.

Importance of Customizing Coverage

It is crucial for individuals to customize their coverage to match their unique circumstances. By selecting the right combination of coverage options, drivers can ensure they are adequately protected without paying for unnecessary coverage. Understanding one's driving habits, lifestyle, and budget can help in choosing the most suitable coverage options for individual needs.

Utilizing Technology for Auto Insurance Shopping

Technology has significantly impacted the auto insurance industry, revolutionizing the way consumers shop for insurance policies. From AI to blockchain technology, these innovations have transformed the insurance landscape, providing more efficient and transparent processes for both insurers and policyholders.

AI Revolutionizing the Insurance Industry

Artificial Intelligence (AI) has played a crucial role in automating various processes within the insurance sector. Insurers are utilizing AI algorithms to streamline underwriting processes, assess risk more accurately, and personalize insurance offerings based on individual needs and behavior. By analyzing vast amounts of data, AI enables insurers to make data-driven decisions quickly and efficiently, ultimately enhancing the overall customer experience.

Role of Blockchain Technology in Insurance Transactions

Blockchain technology has brought about a new level of security and transparency to insurance transactions. By creating a decentralized and tamper-proof ledger, blockchain ensures that all parties involved in a transaction have access to the same information, reducing the risk of fraud and enhancing trust.

Smart contracts enabled by blockchain also automate claim settlements, making the process faster and more reliable.

Telematics Devices for Personalized Insurance Rates

Telematics devices, such as GPS trackers and sensors installed in vehicles, are being used by insurers to track driving behavior and offer personalized insurance rates. These devices collect data on factors like speed, braking patterns, and distance traveled, allowing insurers to assess risk more accurately and adjust premiums accordingly.

This usage-based insurance model incentivizes safe driving habits and provides a more tailored insurance experience for policyholders.

Tips for Saving Money on Auto Insurance in 2025

When it comes to auto insurance, finding ways to save money is always a priority. In 2025, there are several strategies you can use to lower your insurance premiums and get the best deal possible.

Benefits of Bundling Insurance Policies

One effective way to save money on auto insurance in 2025 is by bundling your policies. This means purchasing multiple insurance policies, such as auto and home insurance, from the same provider. By bundling, insurance companies often offer discounts, ultimately resulting in cost savings for you.

Maintaining a Good Driving Record

Another key strategy for saving money on auto insurance is by maintaining a good driving record. Insurance companies reward safe drivers with discounts and lower premiums. By avoiding accidents, traffic violations, and other driving infractions, you can demonstrate to insurers that you are a low-risk driver, leading to potential savings on your auto insurance premiums.

Final Conclusion

In conclusion, Shop for Auto Insurance: The Ultimate 2025 Guide serves as a comprehensive resource that sheds light on the intricacies of auto insurance shopping in the coming years. Armed with this knowledge, you can make informed decisions and secure the best insurance coverage tailored to your needs.

Key Questions Answered

What factors influence auto insurance rates?

Auto insurance rates are influenced by various factors such as the driver's age, driving record, type of vehicle, and location. Insurers also consider credit history and previous insurance coverage.

How can I save money on auto insurance in 2025?

To save money on auto insurance, consider bundling policies, maintaining a good driving record, and exploring discounts for safe driving habits. You can also compare quotes from different insurers to find the best rates.

What are some emerging trends in auto insurance coverage options?

Emerging trends in auto insurance coverage include usage-based insurance, where premiums are based on driving behavior, and customizable policies that cater to individual needs. These options provide more flexibility and personalized coverage.