Delving into the realm of Cheap Auto Insurance and How to Find It Safely, this guide offers a detailed exploration of the key aspects to consider when searching for affordable coverage without compromising quality.

Exploring the factors that influence insurance rates and the strategies to leverage discounts, this guide aims to equip readers with the knowledge needed to make informed decisions about their auto insurance needs.

Understanding Cheap Auto Insurance

Cheap auto insurance refers to affordable coverage that meets the minimum requirements set by the state but may not include extensive options or features.

Factors Influencing Auto Insurance Rates

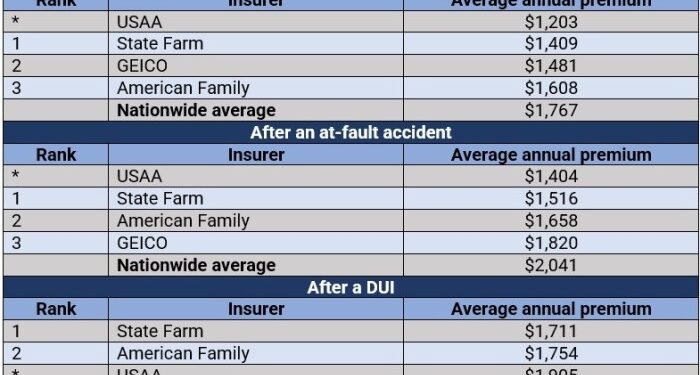

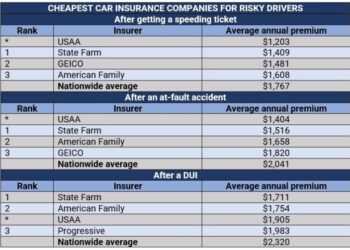

Several factors influence auto insurance rates, including:

- Driving record

- Age and gender

- Type of vehicle

- Location

- Credit score

Importance of Finding Affordable Coverage

It is crucial to find affordable coverage to ensure financial protection in case of accidents while saving money on premiums.

Benefits of Cheap Auto Insurance

Cheap auto insurance offers cost-effective coverage, making it easier for individuals to meet state requirements without breaking the bank. However, it may lack some features or options available in more expensive plans.

How to Find Cheap Auto Insurance Safely

When looking for cheap auto insurance, it's essential to navigate the process safely to ensure you get the best coverage without compromising on quality. Here are some tips to help you find affordable auto insurance without sacrificing protection.

Comparing Insurance Quotes

- Obtain quotes from multiple insurance providers to compare prices and coverage options.

- Consider using online comparison tools to streamline the process and get quotes from different companies simultaneously.

- Review each quote carefully to understand the coverage details and any additional features included.

Researching Company Reputation and Financial Stability

- Check reviews and ratings of insurance companies to gauge customer satisfaction and reliability.

- Verify the financial stability of insurance providers by checking their credit ratings and financial reports.

- Ensure the insurance company has a good track record of handling claims efficiently and fairly.

Understanding Deductibles and Coverage Limits

- Consider how increasing or decreasing deductibles can impact your premium costs.

- Understand the role of coverage limits in determining the extent of protection provided by your insurance policy.

- Balance the cost of premiums with the level of coverage you need to find the right insurance plan for your budget.

Leveraging Discounts for Lower Premiums

- Ask about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for safety features in your vehicle.

- Inquire about discounts for good grades if you're a student or for completing defensive driving courses.

- Bundle your insurance policies with the same provider to potentially qualify for additional discounts on your premiums.

Types of Coverage to Consider

When looking for auto insurance, it's important to understand the different types of coverage available to ensure you have the protection you need. Here we will discuss the basic types of auto insurance coverage, minimum coverage requirements in different states, the advantages and disadvantages of comprehensive coverage, and how personal factors can impact coverage options.

Basic Types of Auto Insurance Coverage

- Liability Coverage: This covers damages and injuries you cause to others in an accident.

- Collision Coverage: This pays for damages to your vehicle in a collision.

- Comprehensive Coverage: This covers non-collision damages such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers regardless of fault.

Minimum Coverage Requirements in Different States

- Each state has its own minimum requirements for auto insurance coverage.

- For example, in California, drivers must have a minimum of $15,000 for bodily injury liability per person and $30,000 per accident.

- It's important to know your state's requirements to ensure you are adequately covered.

Advantages and Disadvantages of Comprehensive Coverage

- Advantages: Comprehensive coverage protects your vehicle from a wide range of risks, offering peace of mind in case of theft, vandalism, or natural disasters.

- Disadvantages: It can be more expensive than basic coverage options like liability, collision, and PIP.

- Consider your vehicle's value and your risk tolerance when deciding if comprehensive coverage is right for you.

Impact of Personal Factors on Coverage Options

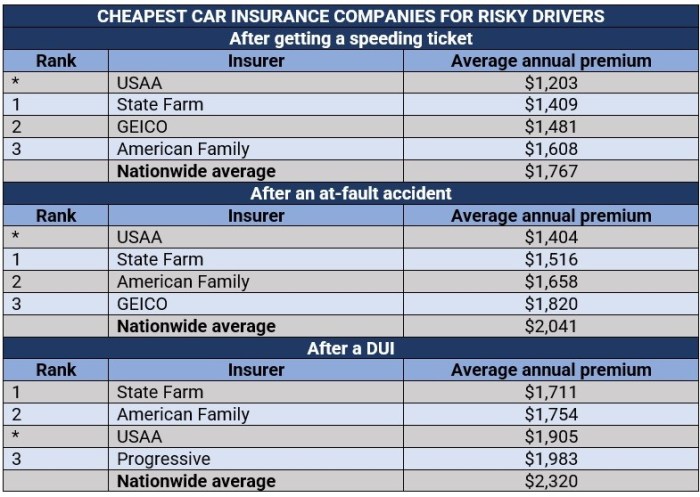

- Factors like your driving record, age, location, and the type of vehicle you drive can impact your insurance options and rates.

- Drivers with a history of accidents or traffic violations may face higher premiums.

- Living in an area prone to theft or natural disasters may increase the need for comprehensive coverage.

Avoiding Scams and Fraudulent Practices

Avoiding scams and fraudulent practices in the auto insurance industry is crucial to protect yourself from financial loss and legal troubles. Here are some tips and guidelines to help you navigate the insurance market safely.

Identifying Common Scams in the Auto Insurance Industry

- Be cautious of unsolicited calls or emails offering extremely low premiums or deals that seem too good to be true.

- Avoid insurance agents who pressure you into making quick decisions without providing adequate information or documentation.

- Watch out for fake insurance companies that mimic the branding of reputable insurers to deceive customers.

Recognizing Legitimate Insurance Offers

- Research the insurance provider online to verify their credentials and check for customer reviews and ratings.

- Ensure the insurance company is licensed in your state by contacting the state insurance department or visiting their website.

- Ask for a written policy document that clearly Artikels the coverage, terms, and conditions before signing any agreements.

Verifying the Credibility of Insurance Providers

- Check the financial stability of the insurance company by reviewing their ratings from independent credit rating agencies.

- Consult with friends, family, or trusted financial advisors for recommendations on reputable insurance providers.

- Visit the National Association of Insurance Commissioners (NAIC) website to access resources for verifying insurance companies and agents.

Importance of Reading Policy Documents Carefully

It is essential to carefully read and understand the policy documents provided by the insurance company to avoid hidden fees, exclusions, or misleading terms. Pay attention to the coverage limits, deductibles, and any additional charges that may apply to your policy.

Final Summary

In conclusion, navigating the world of auto insurance can be daunting, but armed with the right information and strategies Artikeld in this guide, finding cheap and reliable coverage is within reach. Remember, the key lies in balancing affordability with quality to ensure peace of mind on the road.

Common Queries

What factors influence auto insurance rates?

Auto insurance rates are influenced by factors such as age, driving record, location, type of vehicle, and coverage limits.

How can I find legitimate insurance offers?

Research reputable insurance companies, check reviews, and verify their credentials before committing to any offers.

What are the advantages of comprehensive coverage?

Comprehensive coverage offers protection against a wide range of risks, including theft, vandalism, and natural disasters.