Exploring the realm of Automotive Insurance Quote Tips for Better Coverage, this introduction aims to captivate readers with a mix of informative insights and practical advice. It sets the stage for a deep dive into the nuances of insurance coverage, offering a blend of expertise and relatability throughout the discussion.

As we delve further into the intricacies of automotive insurance quotes, readers will gain a clearer understanding of how to navigate the complexities of coverage options and make informed decisions for their specific needs.

Understanding Automotive Insurance Quotes

When it comes to getting an automotive insurance quote, there are several key components to consider. Understanding these components can help you make informed decisions when selecting coverage for your vehicle.

Components of an Insurance Quote

- The type of coverage: This refers to the specific protections included in the policy, such as liability, collision, comprehensive, uninsured motorist, etc.

- Deductibles: The amount you agree to pay out of pocket before your insurance kicks in to cover a claim.

- Coverage limits: The maximum amount your insurance company will pay for a covered claim.

- Discounts: Factors like a good driving record, safety features on your vehicle, or bundling policies can lead to lower premiums.

Factors Influencing Insurance Premiums

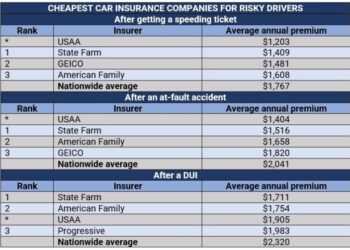

- Driving record: A history of accidents or traffic violations can lead to higher premiums.

- Vehicle make and model: The cost to repair or replace your vehicle can impact your premium.

- Location: Areas with higher rates of accidents, theft, or severe weather may result in higher premiums.

- Age and gender: Younger drivers and males typically pay higher premiums due to higher risk factors.

Impact of Coverage Limits on Quotes

- Higher coverage limits generally lead to higher premiums, as the insurance company is taking on more risk.

- Lower coverage limits may result in lower premiums, but could leave you financially vulnerable in the event of a costly accident.

- It's important to strike a balance between adequate coverage and affordable premiums when selecting coverage limits.

Tips for Obtaining Better Coverage

When it comes to automotive insurance, obtaining better coverage is essential to protect yourself and your vehicle in case of an accident or unexpected event. Here are some tips to help you improve your coverage without significantly increasing costs.

Compare Quotes from Multiple Providers

- It is crucial to compare quotes from multiple insurance providers to ensure you are getting the best coverage at the most competitive price.

- By obtaining quotes from different companies, you can identify any gaps in coverage or potential savings that you may have overlooked.

- Take the time to research and compare policies to find the one that best suits your needs and budget.

Customize Coverage Based on Individual Needs

- Every driver has unique needs and preferences when it comes to insurance coverage.

- Consider customizing your coverage to include specific protections or enhancements that are tailored to your driving habits and lifestyle.

- Some options to consider may include adding roadside assistance, rental car coverage, or higher liability limits.

Maximizing Discounts and Savings

When it comes to automotive insurance, maximizing discounts and savings can help you get better coverage at a lower cost. By taking advantage of available discounts and implementing smart strategies, you can ensure you are getting the most out of your insurance policy.

Common Discounts Available

- Multi-policy discount: You can save money by bundling your automotive insurance with other policies such as home or renters insurance.

- Good driver discount: If you have a clean driving record, you may be eligible for a discount on your premium.

- Good student discount: Students with good grades can often qualify for a discount on their insurance.

- Affiliation discounts: Some insurance companies offer discounts to members of certain organizations or groups.

- Safety feature discounts: Installing safety features in your vehicle, such as anti-theft devices or anti-lock brakes, can lead to lower premiums.

Strategies for Qualifying for Additional Savings

- Shop around: Compare quotes from different insurance companies to find the best rates and discounts.

- Maintain a good credit score: Having a good credit score can often lead to lower insurance premiums.

- Choose a higher deductible: Opting for a higher deductible can lower your premium, but make sure you can afford the out-of-pocket expense if you need to file a claim.

- Drive less: Some insurance companies offer discounts for low-mileage drivers, so consider carpooling or using public transportation to reduce your mileage.

Tips for Leveraging Discounts to Maximize Coverage

- Ask about available discounts: Make sure to inquire about all the discounts that may apply to you when getting a quote.

- Combine discounts: Take advantage of multiple discounts you qualify for to maximize your savings.

- Review and update regularly: Keep track of your discounts and coverage options, and make sure to update your policy as needed to ensure you are still getting the best deal.

- Consider usage-based insurance: Some insurance companies offer discounts based on your driving habits, so consider opting for a usage-based insurance policy if it can save you money.

Understanding Policy Options

When it comes to automotive insurance, understanding the different policy options available is crucial in making informed decisions that best suit your needs and budget. This includes knowing the difference between basic and comprehensive coverage, exploring various policy add-ons, and paying close attention to policy terms and conditions.

Basic vs. Comprehensive Coverage

Basic coverage typically includes the minimum required by law, such as liability insurance to cover damages to other vehicles or property in an accident that you are at fault for. On the other hand, comprehensive coverage offers broader protection by including coverage for damages to your own vehicle due to factors like theft, vandalism, or natural disasters.

Policy Add-Ons and Benefits

- Uninsured/Underinsured Motorist Coverage: Protects you if you are involved in an accident with a driver who lacks insurance or sufficient coverage.

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides services like towing, tire changes, and fuel delivery if your vehicle breaks down.

Importance of Understanding Policy Terms and Conditions

It is crucial to carefully read and understand the terms and conditions of your policy to avoid any surprises or misunderstandings in the event of a claim. Pay attention to details such as coverage limits, deductibles, exclusions, and any specific requirements for filing a claim.

Being well-informed about your policy can help you make the most of your coverage and avoid any unnecessary expenses.

Final Thoughts

In conclusion, the journey through Automotive Insurance Quote Tips for Better Coverage has shed light on key strategies and considerations for optimizing insurance protection. By implementing the insights shared in this guide, individuals can enhance their coverage while navigating the insurance landscape with confidence.

Detailed FAQs

What factors influence insurance premiums?

Insurance premiums are influenced by factors such as age, driving record, type of vehicle, and coverage limits. Insurers assess these variables to determine the level of risk associated with providing coverage.

How can I maximize discounts on automotive insurance?

To maximize discounts, consider bundling policies, maintaining a clean driving record, installing safety features in your vehicle, and inquiring about available discounts with your insurance provider.

What are common policy add-ons for automotive insurance?

Common policy add-ons include roadside assistance, rental car reimbursement, gap coverage, and comprehensive coverage for specific incidents not covered by a basic policy.