Exploring the realm of insurance plans tailored for flooring installers in 2025, this piece invites readers into a world of nuanced details and practical insights. With a focus on providing valuable knowledge, the discussion promises to be informative and intriguing.

The subsequent paragraph will delve into the specifics of insurance coverage, considerations for selection, emerging trends, and tips for choosing the right insurance provider.

Types of Insurance Coverage

Insurance coverage is crucial for flooring installers to protect themselves, their business, and their clients. Understanding the different types of insurance available can help you choose the right coverage for your needs.

Liability Insurance vs. Workers' Compensation

Liability insurance is essential for flooring installers as it protects them in case of property damage or injuries to third parties. On the other hand, workers' compensation provides coverage for employees who are injured on the job. Both types of insurance are important to ensure financial protection in different situations.

General Liability Insurance vs. Professional Liability Insurance

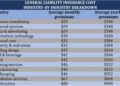

- General Liability Insurance: This type of insurance protects flooring installers from claims of bodily injury, property damage, and advertising injury. It provides coverage for accidents that may occur during the installation process.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects flooring installers from claims of negligence, errors, or omissions in their work. It is especially important for protecting against lawsuits related to mistakes in the installation process.

Comprehensive Insurance Plan with Property Coverage

Having a comprehensive insurance plan that includes property coverage is vital for flooring installers. Property coverage protects your business property, tools, and equipment from damage or theft. This coverage ensures that you can continue operating your business even in the face of unexpected events.

Considerations for Choosing Insurance

When selecting insurance plans, flooring installers should consider various key factors to ensure they have adequate coverage for their business needs. Factors such as the size of the business, specific risks associated with flooring installation projects, and potential liabilities play a crucial role in determining the most suitable insurance coverage.

Impact of Business Size

The size of the business can greatly impact the choice of insurance coverage for flooring installers. Larger businesses with more employees and higher revenue may require broader coverage to protect their assets and investments. On the other hand, smaller businesses may opt for more basic coverage to meet their budget constraints while still providing essential protection.

Assessing Risks in Flooring Installation Projects

It is essential for flooring installers to assess the specific risks associated with their projects to determine the appropriate insurance coverage. Factors such as the type of flooring materials used, the complexity of the installation process, and the potential for accidents or property damage should be carefully considered when selecting insurance plans.

By understanding these risks, flooring installers can choose coverage that adequately protects their business interests.

Potential Liabilities and Risk Mitigation

Flooring installers may face various liabilities in their line of work, such as property damage, injuries to workers or third parties, and errors in installation. Insurance can help mitigate these risks by providing coverage for legal expenses, medical costs, and damages that may arise from such liabilities.

For example, general liability insurance can protect flooring installers against claims of bodily injury or property damage, while professional liability insurance can cover errors or omissions in the installation process.

Emerging Trends in Insurance for 2025

Technology Advancements in Insurance Options for Flooring Installers:Advancements in technology are expected to revolutionize insurance options for flooring installers in 2025. The use of artificial intelligence and data analytics will enable insurers to offer more personalized coverage plans tailored to the specific needs of contractors

This could lead to more efficient claims processing and risk assessment, ultimately benefiting flooring installers.

Potential Changes in Regulations Impacting Insurance Requirements

Regulations governing insurance requirements for contractors are constantly evolving, and 2025 is expected to bring about potential changes that could impact flooring installers. These changes may include stricter licensing requirements, mandatory coverage limits, or new laws addressing liability issues. It is crucial for flooring installers to stay informed about these regulatory developments to ensure compliance and adequate protection.

Shift Towards Sustainable and Eco-Friendly Insurance Options

The construction industry, including flooring installers, is increasingly focused on sustainability and environmental responsibility. In 2025, there is a growing trend towards eco-friendly insurance options that promote green building practices and renewable materials. Insurers may offer discounts or incentives for contractors who choose sustainable insurance coverage, reflecting the industry's commitment to reducing carbon footprint and promoting environmentally conscious practices.

Global Events and Economic Factors Shaping Insurance Offerings

Global events and economic factors play a significant role in shaping insurance offerings for flooring installers in 2025. Factors such as natural disasters, economic downturns, and geopolitical tensions can impact insurance premiums, coverage options, and overall risk management strategies. Flooring installers should be aware of these external factors and work closely with their insurance providers to mitigate potential risks and ensure comprehensive coverage in an ever-changing landscape.

Choosing the Right Insurance Provider

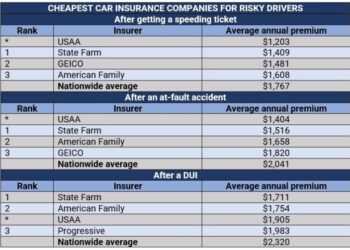

When it comes to selecting an insurance provider for your flooring installation business, there are several important criteria to consider. It is crucial to compare different insurance companies based on their reputation, customer service, and claim processing to ensure you are getting the best coverage for your needs.

Factors to Consider

- Reputation: Look for insurance providers with a strong reputation in the industry. Check reviews and ratings to gauge customer satisfaction and reliability.

- Customer Service: Choose a company that offers excellent customer service and support. You want to work with an insurer that is responsive and attentive to your needs.

- Claim Processing: Evaluate how efficiently and fairly insurance companies handle claims. Quick and hassle-free claim processing is essential in times of need.

Tips for Negotiating

- Compare Multiple Quotes: Obtain quotes from different providers and leverage them to negotiate better premiums and coverage limits.

- Bundling Policies: Consider bundling multiple insurance policies with the same provider to potentially qualify for discounts.

- Review and Update Regularly: It is important to review and update your insurance policies regularly to ensure they align with the evolving needs of your business.

Closure

In conclusion, the journey through the landscape of insurance plans for flooring installers in 2025 reveals a tapestry of essential information and strategic advice. As the industry evolves, staying informed and proactive in choosing the right insurance coverage becomes increasingly vital.

General Inquiries

What factors should flooring installers consider when selecting insurance plans?

Key factors include the size of the business, specific risks associated with flooring projects, and the comprehensiveness of the insurance plan.

How can insurance mitigate potential liabilities for flooring installers?

Insurance can help cover costs related to property damage, injuries on the job, or legal claims, providing financial protection for the installer.

What are some emerging trends in insurance for flooring installers in 2025?

Emerging trends may include advancements in technology impacting insurance options, regulations affecting insurance requirements, and a shift towards eco-friendly insurance solutions.