Exploring the realm of Best Life Insurance Quotes for Parents in 2025, this introduction aims to provide a comprehensive and insightful view of the topic, engaging readers from the outset with valuable information and analysis.

The subsequent paragraph will delve into the specifics of why life insurance is crucial for parents and how quotes can vary based on individual circumstances.

Introduction to Life Insurance Quotes for Parents in 2025

Life insurance is a crucial financial tool for parents to ensure the well-being of their families in the event of unforeseen circumstances. It provides a safety net for children and spouses, offering financial stability and peace of mind during difficult times.

Life insurance quotes can vary significantly based on individual needs, health conditions, age, and lifestyle choices. Factors such as the desired coverage amount, type of policy, and length of coverage can all impact the quotes provided by insurance companies.

The Evolving Landscape of Life Insurance in 2025

Life insurance in 2025 is expected to continue evolving to meet the changing needs of parents and families. With advancements in technology, more personalized and flexible insurance products are likely to be available, catering to diverse family structures and financial goals.

Factors Influencing Life Insurance Quotes

When it comes to determining life insurance quotes for parents, several key factors come into play, influencing the premiums they will pay. Factors such as age, health, occupation, and lifestyle choices play a significant role in shaping the insurance quotes parents receive.

Additionally, the type of policy coverage, term length, and payout options selected also impact the overall cost of life insurance.

Age and Health

Age and health are two of the most critical factors that insurers consider when calculating life insurance quotes for parents. Generally, younger and healthier parents are likely to receive lower premiums compared to older parents or those with pre-existing health conditions.

Insurers assess the risk of mortality based on these factors, which directly influence the cost of coverage.

Occupation

The occupation of a parent can also impact life insurance quotes. Certain occupations that are considered high-risk or dangerous may lead to higher premiums due to the increased likelihood of accidents or injuries. Insurers take into account the level of risk associated with the parent's profession when determining the cost of coverage.

Lifestyle Choices

Lifestyle choices, such as smoking, excessive drinking, or engaging in risky activities, can also affect life insurance quotes for parents. Insurers view these habits as potential health risks that may lead to premature death, thus resulting in higher premiums to offset the increased risk.

Policy Coverage, Term Length, and Payout Options

The type of policy coverage, the length of the term, and the payout options chosen by parents can also influence life insurance quotes. Parents opting for more extensive coverage, longer terms, or additional payout options may incur higher premiums due to the increased benefits and coverage provided by the policy.

Emerging Trends in Life Insurance for Parents

Life insurance products tailored for parents are evolving to meet the changing needs of families in 2025. With advancements in technology and a focus on personalization, the insurance industry is experiencing a shift towards more innovative offerings.

Integration of Technology

- Insurance companies are leveraging technology such as wearables and health apps to gather real-time data on policyholders' health and lifestyle habits.

- This data can be used to offer personalized coverage options that are tailored to each individual's specific needs and risk factors.

- By promoting preventive health measures through technology, insurers are able to reduce the likelihood of claims and provide incentives for policyholders to lead healthier lives.

Wellness Programs and Incentives

- Many insurance companies are introducing wellness programs that encourage parents to adopt healthy behaviors through rewards and discounts on premiums.

- These programs may include fitness challenges, nutrition plans, and mental health resources to support overall well-being.

- By promoting a healthy lifestyle, insurers aim to reduce the risk of chronic diseases and ultimately lower the cost of claims for both the policyholder and the insurer.

Personalized Coverage Options

- Insurance providers are offering more flexibility in coverage options, allowing parents to customize their policies based on their unique circumstances and financial goals.

- Parents can choose from a range of riders and add-ons to enhance their coverage, such as child education benefits, critical illness coverage, or retirement savings components.

- Personalized coverage options ensure that parents have the protection they need for their families, while also providing peace of mind and financial security for the future.

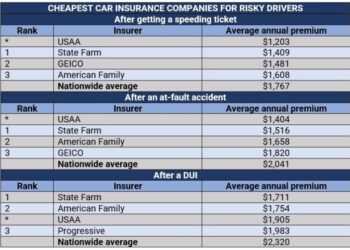

Comparison of Life Insurance Quotes from Different Providers

When looking for life insurance coverage as a parent in 2025, it's crucial to compare quotes from different providers to find the best option for your family's needs. Let's take a closer look at the comparison of life insurance quotes from leading providers in 2025 and analyze the pros and cons of choosing traditional insurance companies versus online platforms.

Traditional Insurance Companies

- Pros:

- Established reputation and stability in the market.

- Personalized service with dedicated agents for assistance.

- Ability to bundle policies for potential discounts.

- Cons:

- Potentially higher premiums compared to online platforms.

- Lengthy application process and approval timelines.

- Limited policy customization options.

Online Platforms

- Pros:

- Convenience of comparing quotes and purchasing policies online.

- Potential for lower premiums due to reduced overhead costs.

- Quick application process and instant policy approval in some cases.

- Cons:

- Lack of personal interaction with agents for guidance.

- Possible concerns about data security and privacy.

- Limited options for policy customization.

Evaluating Quotes

- Financial Stability:

- Check the financial ratings of the insurance company to ensure they can fulfill their obligations in the future.

- Consider the company's history of paying out claims promptly and fairly.

- Customer Service:

- Read reviews and testimonials from other policyholders to gauge the quality of customer service.

- Contact the company with any questions or concerns to assess their responsiveness and helpfulness.

- Policy Flexibility:

- Review the policy options available and the ability to customize coverage to suit your family's specific needs.

- Understand any restrictions or limitations on the policy, such as exclusions or waiting periods.

Tips for Parents to Secure the Best Life Insurance Quotes

When it comes to securing the best life insurance quotes for parents, there are several key tips to keep in mind. By following these practical pieces of advice, parents can ensure they obtain affordable and comprehensive coverage that meets their family's needs.

Assess Coverage Needs Carefully

- Calculate your family's financial obligations, including mortgage, debts, education expenses, and future income needs.

- Consider factors like age of children, spouse's income, and any other dependents to determine the appropriate coverage amount.

- Review existing policies and assess if they provide enough coverage or if additional insurance is necessary.

Choose the Right Policy for Your Family

- Understand the different types of life insurance policies available, such as term life, whole life, or universal life insurance.

- Compare the features, benefits, and costs of each policy to find the one that aligns best with your family's needs and budget.

- Consider the length of coverage, premium affordability, and any exclusions or limitations before making a decision.

Maximize Savings Through Discounts and Customization

- Ask insurance providers about available discounts for bundling policies, maintaining good health, or being a non-smoker.

- Consider customizing your policy with riders or add-ons that provide additional coverage for specific needs, such as critical illness or disability insurance.

- Regularly review and update your policy to ensure it continues to meet your family's evolving needs and lifestyle changes.

Closing Notes

In conclusion, this discussion has shed light on the importance of securing the best life insurance quotes for parents in 2025, emphasizing the need for careful evaluation and consideration to ensure financial protection for your family.

FAQ Section

What factors influence life insurance quotes for parents?

Factors such as age, health, occupation, and lifestyle choices play a significant role in determining insurance premiums for parents.

What are some emerging trends in life insurance for parents in 2025?

New trends include tailored insurance products for parents, advancements in technology like wearables and health apps, and innovative features such as wellness programs.

How can parents secure the best life insurance quotes?

Parents can secure optimal quotes by assessing coverage needs, choosing the right policy, and exploring savings through discounts and customization options.