Bundle Insurance Quotes: How to Save More in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve into the world of insurance bundling, we uncover the secrets to maximizing savings and making informed decisions for the year 2025.

Bundle Insurance Quotes Overview

Bundle insurance quotes refer to the practice of combining multiple insurance policies with the same provider. This typically involves bundling home and auto insurance, but can also include other types of coverage such as renters or life insurance.

Benefits of Bundling Home and Auto Insurance

- Convenience: Bundling your policies with one provider makes it easier to manage your insurance needs in one place.

- Cost Savings: Insurance companies often offer discounts for bundling policies, resulting in lower overall premiums.

- Simplified Claims Process: Having all your policies with one insurer can streamline the claims process and make it easier to coordinate in case of an incident.

Cost Savings with Bundling

When you bundle home and auto insurance, you can enjoy significant cost savings in the long run. Insurance providers are more likely to offer discounts and incentives to customers who choose to consolidate their policies with them. By taking advantage of these bundled discounts, you can reduce your overall insurance costs while still maintaining the coverage you need.

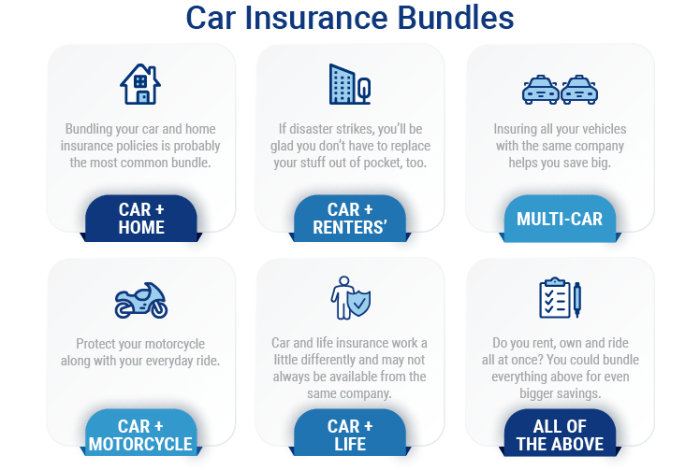

Types of Insurance Bundles

When it comes to insurance bundles, there are various types available to cater to different needs and preferences. Bundling insurance policies can often lead to cost savings and convenience for policyholders.

Home and Auto Insurance Bundle

- One of the most common types of insurance bundles is combining home and auto insurance policies.

- This type of bundle is popular as it offers comprehensive coverage for both your home and vehicles, usually at a discounted rate.

- Policyholders can enjoy the convenience of managing both policies under one provider.

Life and Health Insurance Bundle

- Another popular combination is bundling life and health insurance policies together.

- By opting for this bundle, individuals can ensure financial protection for their loved ones in case of unexpected events, as well as secure coverage for medical expenses.

- This type of bundle is beneficial for those looking to streamline their insurance coverage.

Renter's and Pet Insurance Bundle

- For renters who are also pet owners, bundling renter's and pet insurance can be a smart choice.

- This bundle provides protection for both your rental property and your furry companions, covering liabilities and potential pet-related damages.

- It offers peace of mind for renters who want to ensure the safety and well-being of their pets within their rented space.

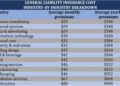

Factors Influencing Bundle Insurance Quotes

When it comes to bundle insurance quotes, there are several factors that can influence the cost. These factors can vary from personal details to the type and amount of coverage included in the bundle.

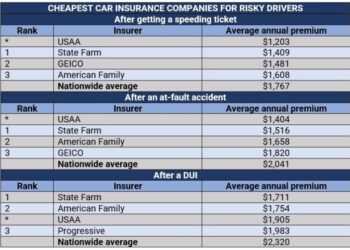

Personal Factors

- Your location plays a significant role in determining your bundle insurance quotes. Urban areas with higher crime rates or greater risk of accidents may result in higher premiums.

- Your credit score is another important factor. A higher credit score is often associated with lower insurance rates, as it is seen as an indicator of financial responsibility.

- Age and driving record are also considered when determining bundle insurance quotes. Younger drivers or those with a history of accidents may face higher premiums.

Type and Amount of Coverage

- The type of insurance coverage included in the bundle can greatly impact the overall cost. Bundling different types of insurance, such as auto and home insurance, can lead to discounts and lower premiums.

- The amount of coverage you choose also plays a role. Opting for higher coverage limits or additional riders can increase the cost of the bundle insurance quotes.

- Deductibles are another factor to consider. Choosing a higher deductible can lower your premiums, but it also means you'll have to pay more out of pocket in the event of a claim.

Tips for Maximizing Savings in 2025

When it comes to maximizing savings through bundle insurance quotes in 2025, there are several strategies you can implement. By negotiating better rates, staying informed about discounts and promotions, and being proactive in your approach, you can make sure you are getting the best possible deal on your insurance policies.

Bundle Multiple Policies Together

- Consider bundling your home and auto insurance policies together with the same provider to take advantage of multi-policy discounts.

- Explore bundling other types of insurance, such as life insurance or renters insurance, with the same company for additional savings.

Review Your Coverage Needs Regularly

- Assess your insurance needs annually to ensure you are not paying for coverage you no longer require.

- Adjust your coverage limits based on changes in your life circumstances to avoid overpaying for insurance.

Shop Around and Compare Quotes

- Obtain quotes from multiple insurance providers to compare rates and coverage options before committing to a bundle.

- Take advantage of online comparison tools to streamline the process and find the best deal for your insurance needs.

Wrap-Up

In conclusion, Bundle Insurance Quotes: How to Save More in 2025 presents a roadmap to financial prudence and smart decision-making when it comes to bundling insurance policies. By following the tips and strategies Artikeld, you can secure a more cost-effective and comprehensive coverage for your needs.

FAQ Guide

What are the benefits of bundling home and auto insurance?

By bundling home and auto insurance, you can often enjoy discounts and lower premiums compared to purchasing separate policies.

How do personal factors like location and credit score impact bundle insurance quotes?

Personal factors like location and credit score can influence bundle insurance quotes by affecting the perceived risk level for the insurance provider.

What tips can help in negotiating better rates when bundling insurance policies?

Some tips for negotiating better rates include comparing quotes from different providers, leveraging loyalty discounts, and bundling multiple policies with the same insurer.