As Full Coverage Insurance Quotes: What You Should Know takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

Introduction to Full Coverage Insurance

Full coverage insurance is a type of auto insurance policy that provides a wide range of protections for drivers. It typically includes a combination of coverage options to help protect you financially in various situations.

Components of Full Coverage Insurance

- Liability Coverage: This component helps cover costs if you're responsible for injuring someone or damaging their property in an accident.

- Collision Coverage: This part of full coverage insurance helps pay for repairs to your own vehicle if you're involved in a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive coverage helps cover damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This component protects you if you're in an accident with a driver who doesn't have insurance or enough insurance to cover your expenses.

Why Full Coverage Insurance is Important for Drivers

Full coverage insurance is essential for drivers because it provides a higher level of protection compared to basic liability coverage. It can help safeguard your finances in case of accidents, theft, or other unforeseen events. Having full coverage insurance can give you peace of mind knowing that you're adequately protected on the road.

Understanding Full Coverage Insurance Quotes

When it comes to full coverage insurance, understanding how quotes are calculated can help you make informed decisions. These quotes are based on various factors that influence the cost of your insurance policy. It is essential to compare quotes from different providers to ensure you get the best coverage at a competitive price.

Factors Influencing the Cost of Full Coverage Insurance

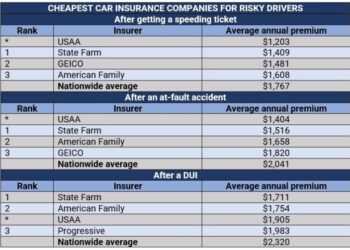

- Your driving record: A clean driving record can result in lower premiums, while a history of accidents or traffic violations may increase the cost of your insurance.

- The type of vehicle you drive: The make and model of your vehicle, as well as its age, can impact the cost of your insurance coverage.

- Your location: Where you live can affect your insurance rates due to factors such as crime rates, traffic congestion, and weather conditions.

- Your age and gender: Younger drivers and males typically pay higher premiums due to statistical data showing a higher risk of accidents.

- Your coverage limits and deductibles: Choosing higher coverage limits and lower deductibles can result in higher premiums, while opting for lower coverage limits and higher deductibles can reduce your costs.

The Importance of Comparing Quotes

- By comparing quotes from different insurance providers, you can ensure you are getting the best value for your money.

- Each insurance company may offer different discounts, coverage options, and pricing structures, so it is essential to shop around.

- Comparing quotes can help you identify any gaps in coverage or potential savings opportunities that you may not have considered.

Coverage Limits and Deductibles

When it comes to full coverage insurance, coverage limits and deductibles play a crucial role in determining the extent of protection and the cost of the policy.

Coverage Limits

Coverage limits refer to the maximum amount an insurance company will pay for a covered claim. These limits are typically set per policy period and can vary depending on the type of coverage.

- For example, a policy may have a liability coverage limit of $100,000 per person and $300,000 per accident. This means the insurance company will pay up to $100,000 for injuries to one person and up to $300,000 for injuries in one accident.

- Higher coverage limits provide more protection but also come with higher premiums, as the insurance company is taking on more risk.

Deductibles

Deductibles are the amount of money you must pay out of pocket before your insurance coverage kicks in. In the context of full coverage insurance, deductibles can apply to different types of coverage, such as collision and comprehensive.

- For example, if you have a $500 deductible for collision coverage and your car sustains $2,000 in damages from an accident, you would pay the first $500, and the insurance company would cover the remaining $1,500.

- Choosing a higher deductible can lower your premiums, as you are taking on more of the financial risk in the event of a claim.

Impact on Insurance Premiums

The choice of coverage limits and deductibles can have a direct impact on the cost of your insurance premiums. Opting for higher coverage limits and lower deductibles will result in higher premiums, while choosing lower coverage limits and higher deductibles will lower your premiums.

- It's important to strike a balance between adequate coverage and affordable premiums based on your individual financial situation and risk tolerance.

- Discussing different scenarios with your insurance provider can help you determine the best combination of coverage limits and deductibles for your needs.

Optional Coverages to Consider

When it comes to full coverage insurance, there are optional coverages that you can add to enhance your policy. These optional coverages provide additional protection and can be beneficial in certain situations.

Rental Reimbursement Coverage

Rental reimbursement coverage helps pay for a rental car if your vehicle is being repaired after a covered accident. This can be useful to ensure you have a means of transportation while your car is in the shop.

Roadside Assistance

Roadside assistance coverage provides help if you experience a breakdown on the road. Services may include towing, fuel delivery, lockout assistance, and more. Having this coverage can give you peace of mind when traveling.

Gap Insurance

Gap insurance covers the difference between what you owe on your car loan and the actual cash value of your vehicle if it is totaled in an accident. This can be beneficial if you owe more on your loan than your car is worth.

Accident Forgiveness

Accident forgiveness may prevent your insurance rates from increasing after your first at-fault accident. This coverage can help you maintain affordable premiums even if you make a mistake on the road.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, or natural disasters. Adding this coverage can provide you with more comprehensive protection.

Umbrella Insurance

Umbrella insurance offers additional liability coverage beyond the limits of your standard auto policy. This can be useful in situations where you are facing a lawsuit or a significant liability claim.

When to Consider Adding Optional Coverages

- If you frequently travel long distances or have a long commute, roadside assistance can be a valuable addition to your policy.

- If you have a new car or a car with a high loan balance, gap insurance can protect you from financial loss in the event of a total loss.

- If you live in an area prone to severe weather or high crime rates, comprehensive coverage can give you peace of mind.

- If you want to protect your assets and savings from potential lawsuits, umbrella insurance is worth considering.

Tips for Getting the Best Full Coverage Insurance Quote

When it comes to securing the best full coverage insurance quote, there are several strategies you can implement to ensure you are getting the most value for your money. From lowering premiums to negotiating with insurance providers, here are some tips to help you navigate the process successfully.

Lowering Full Coverage Insurance Premiums

One effective way to lower your full coverage insurance premiums is by bundling your policies. Combining your auto, home, and other insurance policies under one provider can often result in significant discounts. Additionally, maintaining a clean driving record and opting for a higher deductible can also help reduce your premiums.

Reviewing Coverage Periodically

It is essential to review your coverage periodically to ensure it still meets your current needs. Life circumstances change, and your insurance coverage should reflect those changes. By reassessing your coverage annually, you can make adjustments to your policy that align with your current situation and potentially lower your premiums.

Negotiating with Insurance Providers

Don't be afraid to negotiate with your insurance provider for better rates. Researching competitor quotes and presenting them to your current provider can sometimes lead to rate reductions. Additionally, demonstrating loyalty to your insurance company by bundling policies or remaining a long-standing customer can also result in discounted rates.

End of Discussion

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQ Resource

What factors influence the cost of full coverage insurance?

Factors such as age, driving record, location, and the type of vehicle can influence the cost of full coverage insurance.

How can I lower my full coverage insurance premiums?

You can lower your premiums by maintaining a good driving record, bundling policies, raising deductibles, and qualifying for discounts.