In the realm of contracting, securing affordable general liability insurance is crucial for protecting your business against potential risks. This guide delves into the intricacies of finding cost-effective insurance coverage tailored to contractors' needs. Let's explore the key factors and strategies that can help contractors navigate the realm of insurance with ease.

Understanding General Liability Insurance

General liability insurance is a crucial protection for contractors, as it helps safeguard their business from potential financial losses due to unexpected events. This type of insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims that may arise during the course of business operations.

What General Liability Insurance Typically Covers

- Third-party bodily injury: Covers medical expenses and legal fees if someone is injured on the contractor's premises or as a result of their work.

- Property damage: Provides coverage for damage caused to a client's property during the contractor's work.

- Advertising injury: Protects against claims of copyright infringement, libel, slander, or false advertising in the contractor's marketing materials.

Risks General Liability Insurance Helps Protect Contractors Against

- Lawsuits: In the event of a lawsuit filed by a third party claiming bodily injury, property damage, or advertising injury, general liability insurance helps cover legal fees and settlement costs.

- Medical Expenses: If someone is injured on the contractor's premises, general liability insurance can help cover medical expenses, reducing the financial burden on the contractor.

- Property Damage Costs: Accidents happen, and if the contractor causes damage to a client's property, general liability insurance can help cover the costs of repairs or replacement.

Factors Affecting General Liability Insurance Costs

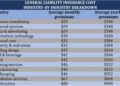

When it comes to determining the cost of general liability insurance for contractors, several factors come into play. Understanding these factors can help contractors make informed decisions when selecting the right insurance coverage for their business.

Size and Type of Contracting Business

The size and type of contracting business can significantly impact insurance costs. Larger companies with more employees and higher revenues may face higher premiums due to the increased risk associated with their operations. Similarly, the type of contracting business, such as construction, landscaping, or roofing, can also influence insurance costs based on the level of risk involved in the industry.

Claims History and Coverage Limits

A contractor's claims history plays a crucial role in determining insurance premiums. A history of frequent claims or high-dollar claims can lead to higher insurance costs as it indicates a higher risk to the insurance provider. Additionally, the coverage limits chosen by the contractor can impact insurance premiums.

Higher coverage limits typically result in higher premiums, as the insurance provider is exposed to greater potential financial liability.

Strategies to Find Affordable General Liability Insurance

When it comes to finding affordable general liability insurance as a contractor, there are several strategies you can utilize to ensure you get the best coverage at the best price. Here are some tips to help you navigate the process:

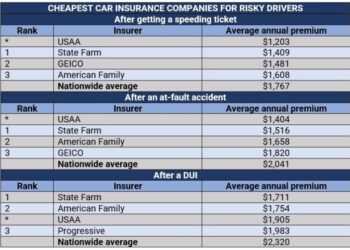

Comparing Quotes from Different Insurance Providers

- Obtain quotes from multiple insurance providers to compare prices and coverage options.

- Consider working with an independent insurance agent who can help you access quotes from various companies.

- Look for insurers that specialize in providing coverage to contractors, as they may offer more competitive rates.

- Review the coverage limits and exclusions in each policy to ensure you are getting the protection you need.

Bundling Insurance Policies to Reduce Costs

- Consider bundling your general liability insurance with other policies, such as commercial property insurance or commercial auto insurance, to receive a discount.

- Ask your insurance provider about available discounts for bundling multiple policies together.

- By consolidating your insurance needs with one provider, you may be able to save money on overall premiums.

Leveraging Professional Associations for Insurance Discounts

- Check if any professional associations or trade organizations you belong to offer group insurance programs for members.

- These group programs may provide discounted rates on general liability insurance for contractors.

- Take advantage of any networking opportunities within these associations to learn about insurance options and discounts available to members.

Importance of Working with an Insurance Broker

When it comes to finding cost-effective insurance for contractors, working with an insurance broker can make a significant difference. These professionals play a crucial role in helping contractors navigate the complex world of insurance and find policies that meet their specific needs while staying within budget.

Role of an Insurance Broker

Insurance brokers act as intermediaries between contractors and insurance companies. They have in-depth knowledge of the insurance market and can leverage their relationships with various insurers to find the best coverage at competitive rates. Brokers work closely with contractors to understand their unique requirements and then tailor insurance policies to suit those needs.

Advantages of Using an Insurance Broker

- Brokers have access to a wide range of insurance options, giving contractors more choices and better chances of finding affordable coverage.

- Insurance brokers can provide expert advice on the type and amount of coverage needed based on the contractor's specific risks and circumstances.

- Brokers handle the legwork of shopping around for insurance quotes, saving contractors time and effort.

- Brokers can assist contractors in understanding complex insurance jargon and clauses, ensuring they make informed decisions.

- Insurance brokers can also help contractors during the claims process, acting as advocates to ensure fair treatment and timely resolution.

Outcome Summary

As we conclude our discussion on finding cheap general liability insurance, it becomes evident that contractors have a range of options and strategies at their disposal to secure the coverage they need without breaking the bank. By understanding the importance of insurance, exploring cost-effective strategies, and leveraging professional resources, contractors can confidently protect their businesses and thrive in their respective industries.

Key Questions Answered

What does general liability insurance cover?

General liability insurance typically covers bodily injury, property damage, and advertising injury claims that a business may face.

How can contractors reduce insurance costs?

Contractors can reduce insurance costs by comparing quotes, bundling policies, and exploring discounts through professional associations.

Why is working with an insurance broker beneficial?

An insurance broker can help customize policies, provide tailored advice, and access a wide range of insurance options to find the best coverage at competitive rates.