As Liability Insurance for HVAC Contractors: Everything You Need takes center stage, this opening passage beckons readers with engaging insights into the world of insurance coverage for HVAC contractors. From defining liability insurance to exploring its importance and benefits, this article provides a comprehensive guide for those in the HVAC industry.

Overview of Liability Insurance for HVAC Contractors

Liability insurance for HVAC contractors is a type of insurance coverage that protects contractors in the heating, ventilation, and air conditioning industry from financial losses resulting from third-party claims of property damage, bodily injury, or other related liabilities.

Importance of Liability Insurance in the HVAC Industry

Having liability insurance is crucial for HVAC contractors as it provides financial protection against potential lawsuits and claims that may arise while working on projects. Without liability insurance, contractors may be personally liable for damages, legal fees, and medical expenses, putting their business and personal assets at risk.

Common Risks HVAC Contractors Face Without Liability Insurance

- Property Damage: HVAC contractors may accidentally damage a client's property during installation or repair work, leading to costly repairs or replacements.

- Bodily Injury: Injuries to clients, bystanders, or other workers can occur on the job site, resulting in medical expenses and potential lawsuits.

- Legal Fees: Defending against lawsuits or claims can be expensive, and without liability insurance, contractors may struggle to cover legal fees and settlements.

- Reputation Damage: Failing to compensate clients for damages or injuries can tarnish the reputation of HVAC contractors and lead to loss of business opportunities.

Types of Liability Insurance Coverage

When it comes to liability insurance coverage for HVAC contractors, there are several types available to protect businesses from potential risks and liabilities. Let's explore the differences between general liability insurance, professional liability insurance, and product liability insurance, along with examples of situations where each type of coverage would be necessary.

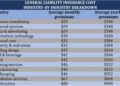

General Liability Insurance

General liability insurance provides coverage for common risks that HVAC contractors may face, such as property damage, bodily injury, and advertising injury. This type of insurance can help cover legal fees, medical expenses, and settlements resulting from accidents or injuries caused by your business operations.

For example, if a customer slips and falls on your job site and sues for damages, general liability insurance would help cover the costs.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is designed to protect HVAC contractors from claims of negligence or professional mistakes that result in financial loss for clients. This type of coverage is essential for situations where a client alleges that your work was substandard or caused damage to their property.

For instance, if a client claims that your HVAC installation led to a fire in their home, professional liability insurance would help cover the costs of legal defense and potential settlements.

Product Liability Insurance

Product liability insurance is crucial for HVAC contractors who manufacture, distribute, or sell HVAC equipment or products. This type of coverage protects businesses from liability claims related to defective products that cause harm or damage to consumers. For example, if a faulty air conditioning unit installed by your company malfunctions and causes property damage or injury, product liability insurance would help cover the costs of legal claims and compensation.

Factors to Consider When Choosing Liability Insurance

When selecting liability insurance, HVAC contractors need to carefully consider several key factors to ensure they have the right coverage for their business needs.

Size of the HVAC Business

The size of the HVAC business plays a crucial role in determining the appropriate liability insurance coverage. Larger businesses with more employees, projects, and assets may require higher coverage limits to protect against potential risks and liabilities.

- Smaller HVAC businesses may opt for basic coverage options to meet their immediate needs without overextending their budget.

- Larger HVAC companies may need broader coverage that includes additional protections for their larger operations and assets.

Role of Coverage Limits, Deductibles, and Premiums

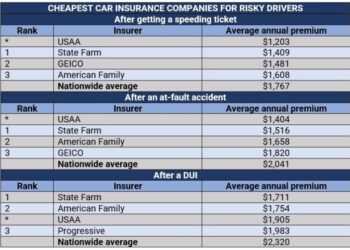

Coverage limits, deductibles, and premiums are important factors to consider when choosing liability insurance as they directly impact the level of protection and cost of coverage.

- Coverage Limits: HVAC contractors should assess their business risks and liabilities to determine the appropriate coverage limits that provide adequate protection in case of a claim or lawsuit.

- Deductibles: Choosing the right deductible amount can help HVAC contractors balance their upfront costs with potential out-of-pocket expenses in the event of a claim.

- Premiums: The cost of insurance premiums should be weighed against the coverage benefits to find a balance that offers sufficient protection at a reasonable price.

Legal Requirements and Regulations

In the HVAC industry, there are specific legal requirements and regulations that contractors need to adhere to when it comes to liability insurance. Failure to comply with these regulations can have serious consequences for HVAC businesses.

Mandatory Liability Insurance Coverage

- HVAC contractors are typically required to carry general liability insurance to protect against third-party claims for bodily injury or property damage.

- Some states may also require contractors to have workers' compensation insurance to cover employees in case of work-related injuries.

State-Specific Regulations

- Each state may have its own regulations regarding the minimum amount of liability insurance coverage that HVAC contractors must carry.

- Contractors must ensure that they are in compliance with these state-specific requirements to avoid fines or penalties.

Impact on Business Operations

- Non-compliance with legal requirements can result in the suspension of business operations or even the loss of licenses to operate.

- Having the appropriate liability insurance coverage not only ensures compliance but also protects the business from financial risks in case of unforeseen incidents.

Benefits of Liability Insurance

Liability insurance for HVAC contractors offers a range of benefits that can protect businesses from financial losses and reputational damage. By having liability insurance in place, HVAC contractors can safeguard their operations and enhance their credibility in the industry.

Protection in Various Scenarios

- Coverage for Property Damage: In the event that an HVAC contractor accidentally damages a client's property while working on a project, liability insurance can cover the costs of repairs or replacements.

- Protection from Lawsuits: If a client or third party files a lawsuit against an HVAC contractor for bodily injury or property damage, liability insurance can help cover legal fees and settlements.

- Medical Expenses Coverage: Liability insurance can also cover medical expenses if a client or third party is injured on the job site due to the HVAC contractor's work.

Enhanced Reputation and Credibility

- Professional Image: Having liability insurance demonstrates to clients that an HVAC contractor is professional, responsible, and committed to protecting their interests.

- Competitive Advantage: HVAC businesses with liability insurance may have a competitive edge over those without it, as clients are more likely to trust contractors who are properly insured.

- Peace of Mind: Knowing that they are covered by liability insurance can give HVAC contractors peace of mind and allow them to focus on delivering quality services without worrying about potential risks.

Cost Considerations and Budgeting

When it comes to budgeting for liability insurance costs as an HVAC contractor, it's essential to understand the factors that influence pricing and explore strategies to manage these costs effectively. By prioritizing the right coverage and negotiating premiums, you can ensure you have adequate protection without breaking the bank.

Strategies for Managing Insurance Costs

One effective strategy for managing insurance costs is to assess your business risks accurately. By understanding the specific liabilities you face as an HVAC contractor, you can tailor your coverage to address these risks without unnecessary add-ons that may increase premiums.

- Regularly review your coverage needs and adjust your policy accordingly to avoid over-insuring.

- Consider bundling your liability insurance with other policies, such as property insurance, to potentially qualify for discounts.

- Implement risk management practices within your business to minimize the likelihood of claims, which can help lower your premiums over time.

Negotiating Insurance Premiums

When negotiating insurance premiums, it's crucial to shop around and compare quotes from multiple insurers to find the best value for your money. Consider the following tips to help you negotiate more effectively:

- Highlight your business's strong safety record and any risk mitigation measures you have in place to demonstrate your commitment to minimizing claims.

- Ask about available discounts or incentives for HVAC contractors, such as professional association memberships or safety training certifications.

- Be prepared to negotiate deductibles and coverage limits to find a balance between affordability and adequate protection for your business.

Claims Process and Handling

When it comes to liability insurance claims for HVAC contractors, understanding the process and knowing how to effectively handle claims is crucial to ensure a smooth experience.

Typical Claims Process

- Notify your insurance provider: As soon as an incident occurs that may lead to a claim, contact your insurance company to notify them.

- Document the details: Keep detailed records of the incident, including photos, witness statements, and any relevant documentation.

- File a claim: Submit a claim form to your insurance provider, providing all necessary information and supporting documents.

- Investigation: The insurance company will investigate the claim to determine liability and coverage.

- Resolution: If the claim is approved, the insurance company will provide compensation according to the policy terms.

Tips for Handling Claims

- Act promptly: Notify your insurance provider as soon as possible after an incident.

- Provide thorough documentation: Keep detailed records and provide all necessary information to support your claim.

- Cooperate with the investigation: Be responsive and cooperative during the claims investigation process.

- Communicate effectively: Keep in touch with your insurance provider and provide updates as needed.

- Seek professional help: If you encounter any difficulties during the claims process, consider seeking assistance from a legal or insurance professional.

Epilogue

In conclusion, Liability Insurance for HVAC Contractors: Everything You Need sheds light on the crucial aspects of insurance coverage in the HVAC sector. From legal requirements to cost considerations and claims handling, this discussion equips HVAC contractors with the knowledge needed to protect their businesses effectively.

Commonly Asked Questions

What is liability insurance for HVAC contractors?

Liability insurance for HVAC contractors provides financial protection against claims of property damage, bodily injury, or other liabilities that may arise during HVAC projects.

How can liability insurance benefit HVAC contractors?

Having liability insurance can safeguard HVAC contractors from potential lawsuits, cover legal expenses, and enhance the credibility of their businesses.

What are the common risks faced by HVAC contractors without liability insurance?

Without liability insurance, HVAC contractors are vulnerable to costly legal actions, financial losses due to accidents, and damage claims that can jeopardize their businesses.