Navigating the world of insurance for home-based businesses can be complex, but with the right information, it becomes manageable. This guide aims to shed light on the essential insurance policies necessary for protecting your home-based business effectively.

Types of Insurance Policies

When it comes to protecting your home-based business, having the right insurance policies in place is crucial. Here, we will explore the different types of insurance policies available for home-based businesses and why they are essential for safeguarding your business interests.

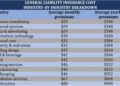

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims. It protects your business from potential lawsuits and financial losses resulting from accidents that occur on your property or due to your business operations.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, offers protection against claims of negligence, errors, or omissions in the services or advice you provide. This type of insurance is essential for consultants, freelancers, and other service-based home businesses.

Business Owner's Policy (BOP)

A Business Owner's Policy (BOP) combines general liability insurance and property insurance into a single package, offering comprehensive coverage for property damage, bodily injury, and other common risks faced by home-based businesses. It is a cost-effective solution for small businesses looking for broad coverage.

Property Insurance

Property insurance covers the physical assets of your home-based business, including equipment, inventory, and furniture, against damage or loss caused by covered perils such as fire, theft, or vandalism. It is essential to protect your business property from unforeseen events that could disrupt your operations.

Business Interruption Insurance

Business interruption insurance provides coverage for lost income and ongoing expenses if your home-based business is unable to operate due to a covered peril, such as a fire or natural disaster. This insurance can help you recover financially and stay afloat during periods of business interruption.

Determining Insurance Needs

Determining the appropriate insurance coverage for a home-based business is crucial to protect the business and its assets. Here is a step-by-step guide on how home-based businesses can assess their insurance needs.

Assessing Business Size and Nature of Operations

- Consider the size of your home-based business in terms of revenue, number of employees, and assets.

- Assess the nature of your operations, including the services you provide, products you sell, and any potential liabilities.

- Identify any specific risks associated with your industry or business activities.

Evaluating Risks Involved

- Assess the potential risks your home-based business may face, such as property damage, liability claims, or business interruption.

- Consider the likelihood of these risks occurring and the potential financial impact on your business.

- Determine which insurance policies can help mitigate these risks and provide adequate coverage.

Examples of Crucial Insurance Policies

- Professional Liability Insurance:Essential for home-based businesses offering professional services to protect against claims of errors, negligence, or malpractice.

- Home Business Insurance:Specifically designed for home-based businesses to cover property damage, liability claims, and business interruption.

- Product Liability Insurance:Necessary for home-based businesses selling physical products to protect against claims of injury or property damage caused by their products.

Cost Considerations

When it comes to insurance for home-based businesses, cost considerations play a significant role in decision-making. Understanding how insurance premiums are calculated, finding ways to reduce costs without sacrificing coverage, and exploring the benefits of bundling policies can help save money in the long run.

Factors Affecting Insurance Premiums

Insurance premiums for home-based businesses are typically calculated based on several factors, including the type of business, coverage limits, location, claims history, and the value of business assets

- Choose the Right Coverage: Opt for policies that specifically cater to your business needs to avoid paying for unnecessary coverage.

- Maintain a Good Claims History: Avoid frequent claims to demonstrate your business's reliability, which can lead to lower premiums over time.

- Implement Safety Measures: Installing security systems, fire alarms, and other safety measures can lower the risk of potential claims, resulting in reduced premiums.

Cost-Saving Strategies

Reducing insurance costs without compromising coverage is a common goal for many home-based businesses. By implementing cost-saving strategies, business owners can effectively manage their insurance expenses while maintaining adequate protection.

"By comparing quotes from multiple insurance providers, you can find competitive rates that align with your budget and coverage needs."

- Bundling Policies: Bundling multiple insurance policies, such as business property, liability, and professional liability insurance, with the same provider can lead to cost savings through multi-policy discounts.

- Review Coverage Annually: Regularly reassess your insurance needs and coverage limits to ensure you are not overpaying for unnecessary protection.

- Consider Higher Deductibles: Opting for higher deductibles can lower your premiums, but make sure you can afford the out-of-pocket costs in the event of a claim.

Legal Requirements and Compliance

When it comes to running a home-based business, legal requirements related to insurance cannot be overlooked. Ensuring compliance with insurance regulations is crucial for protecting your business from potential legal risks.

Importance of Compliance

Complying with insurance regulations not only helps in safeguarding your home-based business but also ensures that you are meeting the legal obligations set forth by authorities. Failure to comply can lead to severe consequences, including legal penalties and financial liabilities.

- Operating without the necessary insurance coverage puts your business at risk of lawsuits in case of accidents or damages occurring on your property.

- Non-compliance with insurance regulations can result in fines, legal actions, or even the closure of your business.

- Having the right insurance coverage in place demonstrates your commitment to legal compliance and can help build trust with clients and partners.

Concluding Remarks

In conclusion, understanding the must-have insurance policies for home-based businesses is crucial for safeguarding your venture against unforeseen risks. By assessing your insurance needs, considering costs, and ensuring legal compliance, you can set your business up for success in the long run.

Common Queries

What factors should home-based businesses consider when assessing their insurance needs?

Home-based businesses should evaluate their business size, nature of operations, and potential risks to determine the appropriate insurance coverage.

How are insurance premiums calculated for home-based businesses?

Insurance premiums for home-based businesses are typically calculated based on factors such as the nature of the business, revenue, location, and coverage needed.

What are the consequences of operating a home-based business without the necessary insurance coverage?

Operating without essential insurance coverage can expose home-based businesses to financial risks, legal liabilities, and potential loss of assets in case of unforeseen events.